Attention all auto policy owners! – Our DCPD blog is just as promised…

As of January 1, 2022, Direct Compensation for Property Damage Insurance (DCPD coverage) will be written into all auto policies in Alberta and will be a mandatory part of auto insurance in our province.

SO, what is there to know about DCPD?

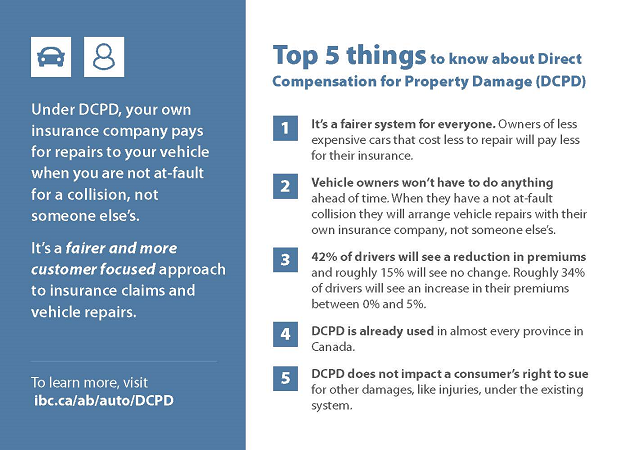

With DCPD, drivers will deal with their own insurers to cover auto repairs if they are involved in a collision, but not at fault. With that, if you had 0 fault in a collision, DCPD would cover 100% of the damages caused to your vehicle.

Of course, the cost of your DCPD coverage will depend on the year, make, and model of your vehicle. If you have a more expensive car, you may be charged more DCPD coverage to compensate for expected repair costs. However, making DCPD claims won’t affect your premiums. As always, your premiums may be affected by accidents where you are partially or wholly at fault.

DCPD is already used in almost every other province in Canada, as it allows for a fairer and more customer-focused approach for auto insurance claims & vehicle repairs.

What we’re here to do…

As you know, our Paramount Claim 3-5-5 process has always ensured your claims are proactively handled to the highest standards. No matter what new legislation is in place, it’s part of our PEAK Promise & one that we will always keep to all of our clients!

In the following weeks, we will continue to post FAQ blogs with any and all DCPD and claims questions that may come up. For now; check out this website for additional information regarding the new legislation: https://www.alberta.ca/automobile-insurance-reform.aspx